Get This Report on Ach Processing

Table of ContentsFacts About Ach Processing RevealedThe 7-Minute Rule for Ach ProcessingThe Basic Principles Of Ach Processing What Does Ach Processing Do?Ach Processing for Beginners

Straight payments can be used by individuals, companies, and other companies to send out money. If you're paying a bill online with your financial institution account, that's an ACH straight repayment.The individual or entity obtaining the cash registers it in their bank account as an ACH credit score. Utilizing ACH transfers to pay bills or make person-to-person settlements offers several benefits, starting with ease.

In addition, an ACH settlement can be much more safe and secure than other types of settlement. Sending and also receiving ACH settlements is typically fast.

The Facts About Ach Processing Revealed

ACH transfers are a lot more affordable when contrasted to wire transfers, which can range between $25 to $75 for international outbound transfers. Wire transfers are recognized for their rate and also are frequently used for same-day solution, however they can often take longer to complete. With a global cord transfer, for circumstances, it may take several organization days for the cash to move from one account to an additional, after that another couple of days for the transfer to clear.

There are some potential disadvantages to remember when utilizing them to move cash from one bank to one more, send out repayments, or pay bills. Several banks enforce limits on just how much cash you can send by means of an ACH transfer. There may be per-transaction limitations, day-to-day limitations, and month-to-month or regular restrictions.

Fascination About Ach Processing

Or one type of ACH transaction may be unlimited yet one more might not. Banks can additionally enforce limits on transfer destinations. If you go over that restriction with multiple ACH transfers from financial savings to one more bank, you could be struck with an excess withdrawal penalty.

When you pick to send an ACH transfer, the moment structure matters. That's since not every bank sends them for bank handling at the exact same time. There might be a cutoff time by which you require to obtain your transfer in to have it refined for the next organization day.

ACH takes an average of one to 3 service days to complete and also is taken into consideration sluggish in the period of fintech and immediate settlements. Same-Day official website ACH handling is growing in order to solve the slow service of the basic ACH system. Same-Day ACH volume increased by 73. 9% in 2021 from 2020, with a total amount of 603 million settlements made.

Ach Processing Things To Know Before You Get This

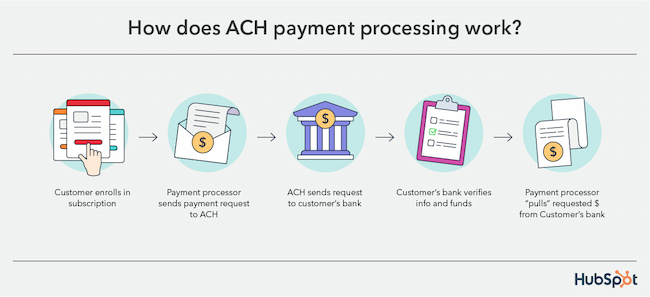

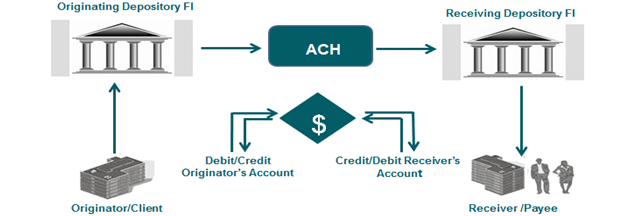

An ACH bank transfer is a digital settlement made between banks for settlement purposes. ACH bank transfers are used for several purposes, such as straight down payments of paychecks, financial obligations for normal payments, as well as cash transfers.

Both wire transfers as well as ACH deals are utilized to promote the motion of money. Cable transfers usually happen on the exact same day and set you back even more. ACH transfers typically take longer to complete; however, same-day ACH transfers are coming to be extra usual - ach processing. ACH is likewise for domestic transfers whereas international here are the findings transfers are done by cable transfers.

Unknown Facts About Ach Processing

Either method, see to it you recognize your bank's plans for ACH straight down payments and straight settlements. Likewise, be vigilant for ACH transfer frauds. A common rip-off, as an example, includes somebody sending you an e-mail telling you that you're owed try this money, as well as all you require to do to obtain it is provide your savings account number and also routing number.

Editor's note: This post was initial released April 29, 2020 and last updated January 13, 2022 ACH represents Automated Clearing House, an U.S. monetary network utilized for digital settlements as well as cash transfers. Known as "direct payments," ACH settlements are a method to transfer money from one bank account to an additional without making use of paper checks, credit rating card networks, cable transfers, or money.

As a customer, it's most likely you're already familiar with ACH settlements, also though you may not be conscious of the lingo. If you pay your costs digitally (instead of creating a check or going into a credit rating card number) or get direct down payment from your employer, the ACH network is possibly at work.

Comments on “Excitement About Ach Processing”